Bitcoin Slightly Drops On Favorable Vanishing

블록스트리트 등록 2025-07-22 16:46 수정 2025-07-22 16:46

BTC Maintains $117K Due to the End of High-Rise Fairness

Major Altcoins Also Fall...Smaller Altcoins, Pumping Up

Experts "Altcoin Will Rise in the Circulation of Funds"

Bitcoin and cryptocurrencies soared on the news of the passage of three cryptocurrency regulations in the U.S. Congress last week. However, Bitcoin and major altcoins fell after the favorable factors that will drive further market gains disappeared.

Last week, a number of altcoins alternately pumped into the funds flowing in from the market's rise.

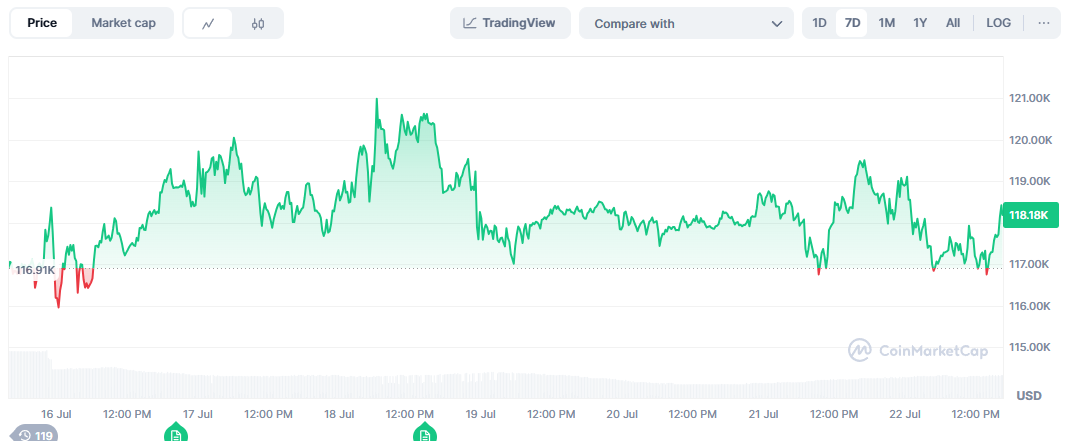

Bitcoin remained around $117,000. Ethereum(ETH) and XRP were down about 2.5% from the previous day, while Solana(SOL) was up about 5%.

Analysts say institutional buying played a role in Solana's rise. "Solana is recording high trading volume," said David Duong, head of Coinbase Research. "Both Ethereum and Solana are attracting attention from institutional investors."

◇Bitcoin = Bitcoin price is $118,185 at 4:30 p.m. on Jul. 18, 2025. Bitcoin share(Dominance) stood at 60.98%.

The long(up) and short(down) betting ratios in the Bitcoin futures market stood at 49.94% and 50.06%, according to the on-chain analytics platform Sigbtc.

Experts predicted that the funds that had been concentrated in Bitcoin would be circulated to altcoins.

"There is a capital cycle in which investors are redistributing assets from bitcoin to altcoins," Bitfinex analysts said in a report. "This suggests that the growth of altcoins has begun amid the overall bull market."

◇Upward Coin = The cryptocurrency that recorded the largest increase from the previous trading day at 4:30 p.m. on Jul. 22 was Strike(STRIKE), up about 123% on the day alone.

Strike showed a phenomenon that skyrocketed to Upbit's decision to delist.

Upbit said it will suspend trading of Strike's won and bitcoin markets from 3 p.m. on Aug. 21. It says it will follow a joint decision by the members of the Digital Asset Exchange Joint Consultative Group (DAXA).

Upbit explained the reason for the end of the transaction support, saying, "Strike's issuing and operating entity does not disclose important matters in a timely manner, the white paper is not confirmed, and the reality and sustainability of the business are insufficient."

◇Fear Greed Index = Digital asset fear-greed index provided by Alternative has entered the 'greed' phase with 72 points. The greed phase is a phase where price volatility and trading volume increase, and the price increases. The government should be cautious about selling products as it is highly likely to form a short-term high.

The cryptocurrency relative strength index(RSI) provided by Sigbtc was 51.2, which was in a 'neutral' state. RSI sets the relative strength between the upward and downward pressure of a particular asset price and is an indicator of a measure of over-purchasing and over-selling of a particular asset.

권승원 기자 ksw@blockstreet.co.kr