Bitcoin Rides On Tension Ahead Of U.S. CPI Announcement

블록스트리트 등록 2025-06-11 16:59 수정 2025-06-11 16:59

Experts "U.S. Economic Indicators Will Break Market Balance"

BTC Sideways...Altcoin Rises More Than 10% On Inflow Funds

CryptoQuant Claims "BTC Data Got Ready for Surge Soon"

The direction of the market is expected to be determined by the announcement of the CPI results in May in the U.S. Dominic John Kronos, an analyst at Research, said in a double-rock that "market sentiment is currently in equilibrium," adding, "Many analysts believe that the U.S. CPI and producer price index(PPI) for May will determine the direction of the short-term market."

Amid Bitcoin's sideways trend, altcoins alternately pumped up funds flowing into the market this week. "Light" altcoins with low market capitalization recorded a rise of more than 10%.

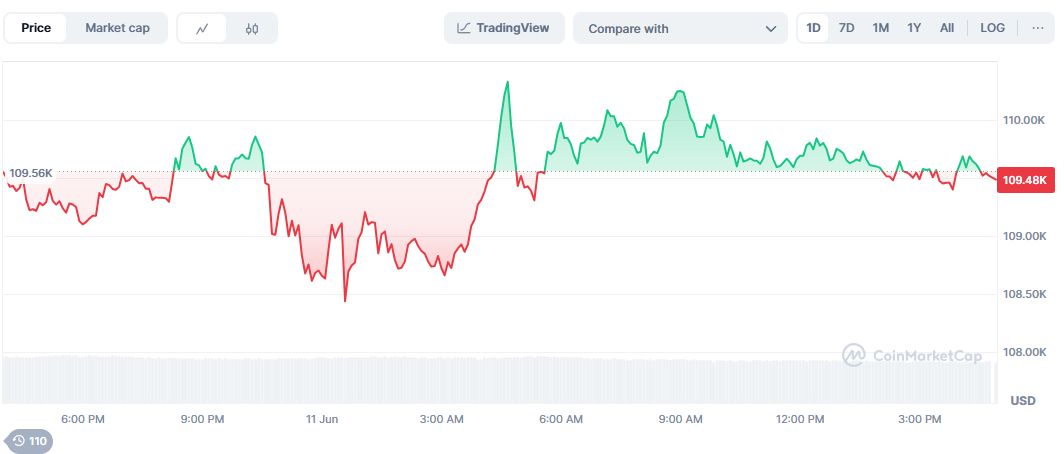

◇Bitcoin = Bitcoin price is $109,486 at 4:30 p.m. on Jun. 11, 2025. The Bitcoin share(dominance) was 64.00%.

The long(up) and short(down) betting ratios in the Bitcoin futures market stood at 34.00% and 66.00%, according to the on-chain analytics platform Sigbtc.

CryptoQuant, an on-chain analysis platform, predicted that Bitcoin is about to soar based on the correlation between the Bitcoin Network Activity Index(NAI) and Bitcoin prices.

In fact, according to the graph presented by CryptoQuant, NAI maintained a nearly direct relationship with the price of Bitcoin, and at the same time, the price of Bitcoin continued to plunge and rise.

CryptoQuant pointed to the fact that NAI is now down to 3470, an 18-month low. "The silence of NAI data often signals a storm," CryptoQuant explained.

◇Upward Coin = The cryptocurrency that recorded the largest increase from the previous trading day at 4:30 p.m. on Apr. 11 was Bora(BORA), up about 11% on the day alone.

Bora, a representative native non-fungible token(NFT), is attracting attention as a decentralized digital currency based on blockchain technology.

The Bora Project aims to develop a comprehensive game and content platform that provides functions such as NFT marketplaces, AMM Dex, and communities to revitalize the blockchain game ecosystem made up of the game player token economy.

◇Fear Greed Index = Digital asset fear-greed index provided by Alternative has entered the 'greed' phase with 72 points. The 'reed phase is a phase where price volatility and trading volume increase, and the price increases. The government should be cautious about selling products as it is highly likely to form a short-term high.

The cryptocurrency relative strength index(RSI) provided by Sigbtc was 63.8, which was in a 'neutral' state. RSI sets the relative strength between the upward and downward pressure of a particular asset price and is an indicator of a measure of over-purchasing and over-selling of a particular asset.

권승원 기자 ksw@blockstreet.co.kr