Bitcoin Continues Quiet Sidewalk Despite Good News Vanishing

블록스트리트 등록 2025-04-28 16:34 수정 2025-04-28 16:34

BTC Flips on Capital Inflow as Dollar Weakens

Altcoin Continues Horizontal Following BTC Flow

NYDIG "BTC Turns into Safe Assets from April"

The global asset market was mixed on the 28th after the tariff war initiated by U.S. President Trump failed to reach a significant conclusion. In particular, the U.S. dollar is weak. Despite the rise on the 28th, the dollar index hit 99.82, the lowest level in about three years.

Bitcoin and cryptocurrency markets defended their prices after last week's surge amid the dollar's weakness, but remained at a similar price point to last week on Friday due to a lack of additional favorable factors.

In particular, it was found that the net inflow of Bitcoin Spot Exchange Traded Fund(ETF) in the U.S., which was introduced last week, is contributing significantly to the maintenance of Bitcoin's price. According to Trader T, about 380 million dollars (545.9 billion won) was net inflow into the spot ETF of Bitcoin in the U.S. last week on the 25th (local time). It has been a net inflow for six consecutive trading days.

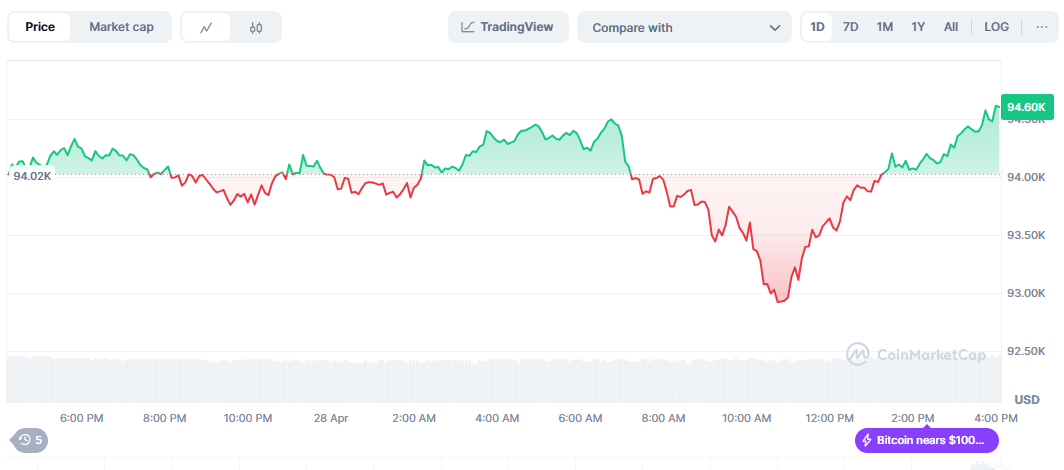

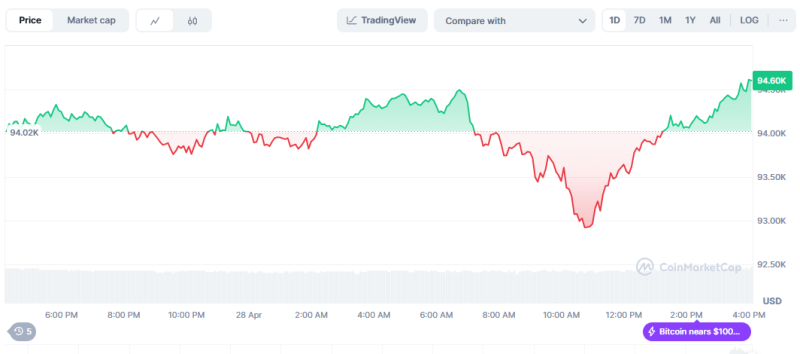

◇Bitcoin = Bitcoin price is $94,606 at 4:30 p.m. on Apr. 28, 2025. The Bitcoin share(dominance) was 64.21%.

The long(up) and short(down) betting ratios in the Bitcoin futures market stood at 41.38% and 58.62%, according to the on-chain analytics platform Sigbtc.

Based on Bitcoin's movement in April, it was suggested that Bitcoin began to transform into a safe asset such as gold.

In a report published on the 28th, the New York Digital Investment Group(NYDIG) identified Bitcoin's trading patterns for April and pointed out that Bitcoin is being separated from risky assets.

"During April, Bitcoin showed a different pattern from existing risky assets," said Greg Chipolaro, head of NYDIG Global. "Bitcoin's buying and price movements during April were clearly closer to safe assets than risky assets such as leverage-based U.S. stocks."

"In particular, the flow of Bitcoin has been shown as a value store where the subject of the asset producer is not clear," he stressed.

◇Upward Coin = The cryptocurrency that recorded the largest increase from the previous trading day at 4:30 p.m. on Apr. 24 was ARDON(ARDR), up about 15% on the day alone.

ARDR is an open-source multi-chain BaaS (Blockchain as a Service) platform created by the Zelurida Foundation by improving the existing NXT and is also called NXT 2.0.

The monetary unit is an ARDR token and the main chain token of the Arthur network, used for the creation of new blocks and the payment of governance and transaction fees for network consensus.

◇Fear Greed Index = The digital asset fear-greed index provided by Alternative has entered the 'neutral' stage with 54 points. The neutral stage is a section where the psychological resistance and support of market participants appear, and important decision-making actions appear in future price movements.

The cryptocurrency relative strength index(RSI) provided by Sigbtc was 60.4, which was in a 'neutral' state. RSI sets the relative strength between the upward and downward pressure of a particular asset price and is an indicator of a measure of over-purchasing and over-selling of a particular asset.

권승원 기자 ksw@blockstreet.co.kr